“Should I take out an HDB loan or a bank loan for my property?” This question has been an integral part of every homeowner’s property purchase story.

Having a good understanding of both is essential in deciding which to go for. In this article, we compare the two and weigh in on the factors for consideration.

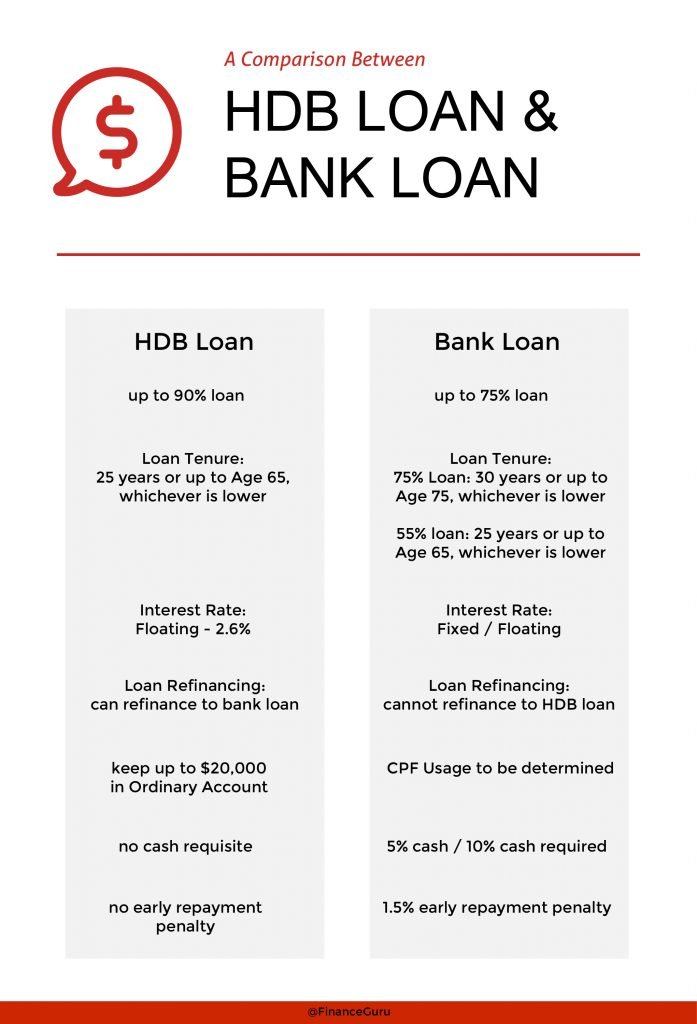

5 key factors of consideration

1. Interest rates

HDB loans

The interest rate for HDB home loans is pegged to our CPF Ordinary Account interest rate + 0.1%.

As the CPF Ordinary Account interest rate is 2.5%, the HDB loan interest rate is currently 2.6%.

In fact, the HDB loan interest rate has been at 2.6% for the past 16 years and does not seem to be changing anytime soon. If you were to take out an HDB home loan, you’d likely be paying the same amount every month.

Bank loans

If you choose to go with a bank loan, you can pick between fixed and floating rates.

Fixed rates are very stable and are suitable for risk-averse individuals. On the other hand, floating or variable rates, comprise of SIBOR, SORA, fixed deposit pegged rates, and board rates.

SIBOR rates have hit an all-time low in the second half of 2020. Here’s the recent SIBOR rate as of 9 December 2020:

| Month | Rate |

|---|---|

| 1-month | 0.25000% |

| 3-month | 0.40542% |

| 6-month | 0.59300% |

| 12-month | 0.81158% |

Learn more about SIBOR and other home loan jargons here.

2. Downpayment

HDB loans

You can take out an HDB home loan of up to 90% if the property’s remaining lease can cover the youngest buyer until at least age 95.

This is so even if the remaining lease of the flat is less than 60 years. Otherwise, the Loan-to-Value limit of 90% will be prorated.

As for the remaining 10% downpayment, you may settle fully with the monies in your CPF Ordinary Account.

Bank loans

You can only take out a bank loan of up to 75%, which means you have to pay a higher down payment sum – the remaining 25% – by your own efforts. 5% of which has to be in cash.

If you prefer not to fork out cold, hard cash to pay for your property, you can consider taking out an HDB loan instead.

3. Early repayment penalties

HDB loans

There might be several reasons why you’d want to pay off your home loan early. For example:

- you may want to purchase another property

- the interest rates on your current home loan package are high

- You have credit-related reasons to pay off your home loan

- You do not want to have a loan hanging over the head

With an HDB home loan, there are no early repayment penalties.

Bank loans

On the other hand, banks in Singapore usually charge an early loan repayment penalty. The penalty differs depending on which bank and loan package you signed up for, and is typically 1.5% on the amount redeemed.

Read our guide to getting a home loan in Singapore here.

4. CPF usage

HDB loans

In the past, you’d have to fully make use of the balances in your CPF Ordinary Account when taking out an HDB home loan.

Today, you can keep up to $20,000 in your CPF Ordinary Account. Buying a flat in Singapore will no longer drain your CPF, and even encourages sufficient retirement savings.

Bank loans

If you take out a bank loan, you have the option of choosing not to touch your CPF savings at all.

This way, you can leave the funds in the CPF Ordinary Account to earn the accrued interest.

5. Buying a new HDB flat after disposing of the existing one

HDB loans

Thinking of taking up a second HDB home loan to purchase a new HDB flat after selling your existing one?

Note that you’ll have to allocate up to 50% of the cash proceeds from the old HDB flat’s sale to purchase the next flat.

Bank loans

If you choose to take up a bank loan to purchase a new HDB flat after selling the existing one, there are no restrictions imposed on how much of the cash proceeds you have to set aside to purchase the next flat.

Read: Step-by-step guide on how to purchase a resale private property.

Now that we have gone through the top 5 factors of consideration, you’ll have to evaluate your lifestyle choices, your approach to risk management, and last but not least, your financial status to determine whether you should take out an HDB home loan or a bank loan for your property purchase.

How does a mortgage broker come into play? Find out here.

Have further queries on mortgage loans? Feel free to contact us for a chat. Here at FinanceGuru, we seek to help you better prepare for your finances and the upcoming milestones in your life. Get a non-obligatory assessment and loan product recommendations here.